Boards have a strategic role looking after the long-term interests of the organisation. Starting off with well-oiled systems and processes will take out the stress from the task of governing and help execute their responsibilities with effect.

Setting up your systems online can make a big difference. Having access to minutes and agendas anywhere at any time with software portals like Process PA not only delivers transparency across the governance process but also helps with the follow up and actioning of items. A progressive board will extend this further and demand well rounded financial reports to ensure its effectiveness.

It is vital that they have the right reports to support that role. In this article we’ll focus on the financial reports that can make a difference to Not-for-Profit board members.

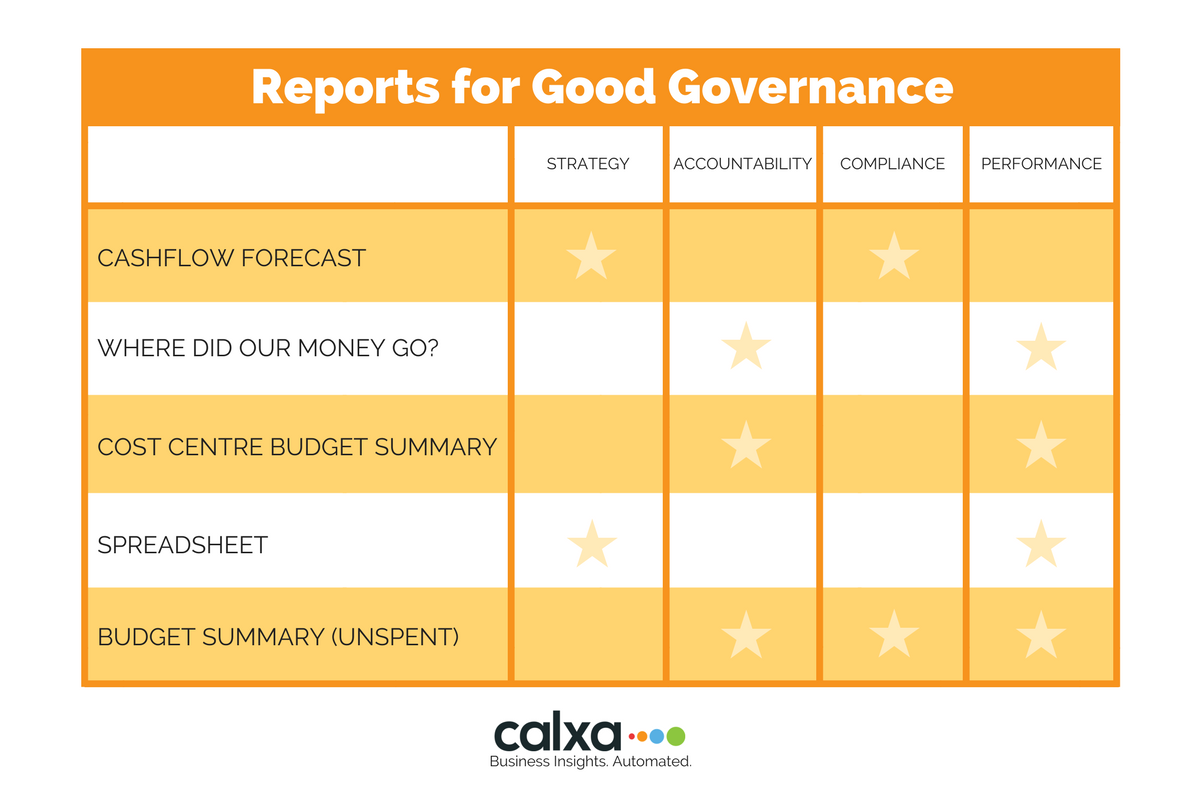

When we talk about good governance, we’re talking about how well the organisation is run. In particular, in the areas of strategy, accountability, compliance and performance. Managing and monitoring these is one of the key tasks of the board. We need to recognise that many board members, especially in the NFP sector, aren’t always familiar with accounting reports and terminology. So we’ll focus on providing them with just enough information. This will enable them to make decisions without too much information that they drown in detail.

Strategy

To make decisions on the long-term strategic direction of the organisation, the board needs reports that look ahead into the future. The simplest of these is a Budget Profit & Loss Spreadsheet report. This shows expected income and expenses (and profit or loss) monthly for the next 12 months. Ideally this report would be summarised so that it fits on one page. Board members don’t need to know exactly how much was spent on postage stamps but they do need to understand the total administration expenses.

The second important strategic report is the Cashflow Forecast. Boards are responsible for ensuring the future financial viability of the organisation. Particularly that it’s not breaking the law by trading while insolvent. The only way to do this is to regularly review forecasts of future cashflow. In the past this has been difficult because the calculations involved are beyond most spreadsheet users. Modern software such as Calxa can greatly simplify this process.

Accountability

Boards are responsible for their organisations and the CEO and staff are answerable to the board. It’s important for board members to get reports that show how money has been spent and how that compares to what was planned to spend. Again, it’s best to summarise unless detail is really necessary.

Calxa Premier has a useful Cost Centre Budget Summary report which is great in this respect (though you could reproduce the same information in a spreadsheet). It shows just one line for each program, showing Income, Expense and Profit for the budgets and actuals for month and year to date. It’s just enough information to quickly see which programs are on track and which are in trouble. Where more detail may be required, Calxa’s Budget Summary (Unspent) report gives just that. It shows actual performance compared to budget for the month, year to date and against the annual budget.

To see what has been spent you could construct a traditional Statement of Cashflows (unless your accounting software has one – MYOB has a simple one) or Calxa’s Where Did Our Money Go?

Compliance

There are 2 strands to monitoring compliance in a Not-for-Profit. One is compliance with laws and regulations. Then there is also the additional need to ensure compliance with terms of grants and other funding. The trading while insolvent requirements we mentioned earlier, and they are best dealt with by a Cashflow Forecast. Grants can be managed by something like Calxa’s Budget Summary (Unspent) – or the spreadsheet equivalent – which shows progress against the annual budget or even the Reforecast Unspent Budget Spreadsheet. This report recalculates budgets for the remainder of the year to show what’s left to spend, adjusted for what has already been spent.

Performance

Managers are frequently held to account by comparing their actual results to either the approved budget (signed off at the beginning of the year) or the current forecast which has been more recently updated. At a high level the Cost Centre Budget Summary report will give a good overview and for more detail use the Budget Summary or the P & L Spreadsheet reports.

In Conclusion

Board members generally don’t want to be swamped by numerous reports and so I’ve tried here to use reports that serve more than one purpose. The Cashflow Forecast, for example, is useful for both strategy and compliance; the Budget Summary for accountability, compliance and performance.

The examples used are based on Calxa Premier because that’s the most commonly used reporting and budgeting tool in the NFP sector in Australia. However, all of them can be reproduced in a spreadsheet by someone with the right skills and time on hand. If you want to have a look at Calxa Premier, it is available as a donation through Connecting Up.

Article originally posted here.